More About DST

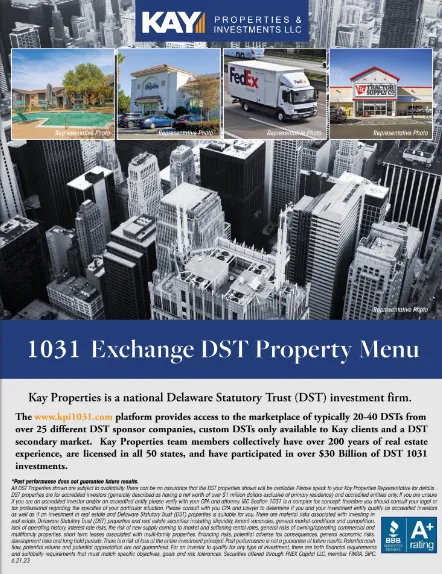

1031 Exchange DST Property Menu

The www.kpi1031.com platform provides 1031 exchange investors access to the marketplace of typically 20-40 DSTs from over 25 different DST sponsor companies, custom DSTs only available to Kay clients, and a DST secondary market. Kay Properties team members collectively have over 200 years of real estate experience and have participated in over $30 Billion of DST 1031 investments.

Introduction to DST Properties for

1031 Exchange Investors

DST 1031 properties also have various financing ratios to satisfy an investor’s exchange requirements of taking on

“equal or greater debt,” as defined by the Internal Revenue Code Section 1031.

However, some DST 1031 properties are

offered all-cash, debt-free in order to mitigate the risk of using financing when purchasing real estate.

1031 DST Digest

Under this 100-year-old law, real

estate investors can defer taxes on

capital gains, reposition real estate

portfolios, create a tool for transferring wealth across generations,

and help create more quality time

for enjoying life and spending time

with heirs.

Now over the past century, countless investors have leveraged the positive impact of 1031 exchanges as an important vehicle to create a better life for themselves and their heirs.